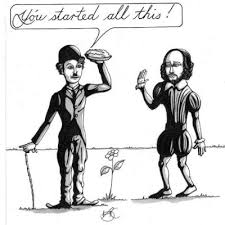

Apple’s Pie Face-off: How Big is Your Piece?

“As the Japanese put it, ‘engineers make the pie grow larger; lawyers only decide how to carve it up.’” – Derek Bo, President at Harvard, 1983

The recent Supreme Court ruling on Apple Inc. v. Pepper opened the courtroom doors where “iPhone app purchasers can sue the tech giant for antitrust damages over its app store and pricing scheme.” An observation and question:

- One can expect an increase of frivolous lawsuits, especially in the State of California, home to Silicon Valley. Why? Few cases have merit and certain states lend themselves to this practice.

- How many purchasers can be expected to financially endure lengthy litigation?

As it applies to this case, plaintiffs may see it all the way through. In MarketWatch, Therese Poletti notes, “Dan Ives, a Wedbush Securities analyst, does not believe Apple will settle but that the case will result in an eventual judgment against Apple in the hundreds of millions of dollars.” I’m divided on this: Plaintiffs were determined enough to endure eight years of litigation leading me to think they may see this all the way through. Then again, Apple’s deep coffers may oblige and “bleed them dry.”

The Developer

Are we losing sight of the third key player, app developers? Technically speaking, they are the party assessed Apple’s 30% commission fee. Issie Lapowsky from Wired explains, “Apple argued that App Store customers technically buy apps from third-party developers and have no direct purchasing relationship with Apple…” Let’s apply this hypothetically to a car dealership:

You go to the dealership to purchase parts and find out they’re marked up 30%! The salesperson (Apple) argues that the customers (You) technically buy car parts from third-party suppliers (developers) and have no direct purchasing relationship with the dealership (Apple). Simply put, the salesperson is charging developers a commission to make the sale, only you the customer ends up paying for it. Once the dealer (Apple) has sold you the car (iPhone), be prepared to pay 30% more when taking your car in for parts. “How do you like them apples?“

Referring to suppliers, AnnaLee Saxenian writes in her book Regional Advantage. Culture and Competition in Silicon Valley and Route 128, “According to one Apple purchasing manager: ‘We have found you don’t always need a formal contract . . . If you develop trust with your suppliers, you don’t need armies of attorneys.’ It appears trust either no longer exists in Silicon Valley or does not apply to developers.

This begs the question, why aren’t the developers filing suit? According to The Verge’s Adi Robertson, “developers would risk damaging an important relationship if they sue a platform, and they can raise prices to cover inflated costs.” Exactly. Imagine Mercedes-Benz suing Fletcher Jones of Fremont or Tesla Motors suing Elon Musk.

The new “service economies” where transactions are in the cloud facilitated by the “invisible hand” appear to benefit only the interests of tech companies; a constant reminder that the user is getting the raw end of the deal. And this lawyer should know, “The person that bears the brunt of antitrust violations tends to be the consumer,” explains John Bergmayer, senior counsel at digital rights nonprofit Public Knowledge.”

Investors: Maximizing returns vs “Smart, long term bets”

In the grand scheme of things, there is an outside player – investors. Investors are looking at the bigger picture; how will the ruling affect Apple stock and as securities analyst Ives points out “potentially pressure Apple’s piece of the pie on this $15 billion revenue stream”? But do investors have anything to lose? That may depend whether you’re short-term vs long-term focused.

Short-term investors have become prevalent in recent decades allowing for quick profits and low risk. Or, what Ron Shaich, founder and former chairman and CEO of Panera Bread calls “activism…folks with a short-term focus and financial engineering playbooks who feel the power and the ability to move a company.” By contrast, Shaich sees Panera’s history as one with “smart, long term bets.”

Yet, long-term investing is becoming a gamble especially for small businesses in part due to regulation and the implications from legal judgments like Apple Inc. v. Pepper. Consider the “law of unintended consequences”; small tech companies facing potential lawsuits.

Unlike their giant tech competitors, small companies may be unable to endure a long “face-off”, benefiting Apple. An outcome that points to Shaich’s analysis of companies like Apple, with “the success and the ability to manage for the long term…structural mechanisms that give them the capability to do just that.” Built into this infrastructure is top-level in-house counsel.

Saxenian goes on to say that “As an industry consultant described it: ‘Company lawyers are trained to write 90 paragraphs to protect their client, but in the end, the relationship is based on mutual trust. If you don’t have that mutual trust, then you probably shouldn’t have the marriage in the first place.’” Yes, but the issue here rests not on trust per se but on an imbalance of profit sharing and how the consumer “bears the brunt of antitrust violations” as noted above by senior counsel John Bergmayer.

Speaking on the subject of marriage, Jason Pontin, former Editor of MIT Technology Review, insightful words of a decade ago come to mind, “Some perfectionist companies forswear openness because closed software can be more beautiful, particularly if it is married to hardware, like the Apple Macintosh operating system. But most technologists want their software to be open, because openness attracts innovation.”

Openness also attracts customers, as Apple seemingly and readily learned, embracing it along with its profits. The software may not be “more beautiful” but it sure is popular and pretty darn expensive. Is beauty in the eye and hand of he who holds her?

Engineers: Gaining the System

Let’s ask the industrial engineer Tim Cook, Apple CEO. Cook argues, “So, everybody is gaining from iPhone. In particular, it’s been a job engine in mobile APP development.” Sir, that depends on who you mean by “everybody” and what you mean by “gaining.” App development comes at a cost but it’s a cost endured by the developer who then passes it on to the user.

It seems to me Apple’s “gaining’ may not only have been about selling the iPhone but about users buying apps strictly from Apple and “servicing” the phone with data. Investors stood to gain all the while users were pacified with their pretty expensive toys from the “play store.” Users may want to get out of their playpens and rethink their purchasing power and those pretty expensive “selfies.”

If the final verdict is for the plaintiff, will app developers end their “marriage” with Apple? More importantly, will customers trust themselves to “push back” and end tech company relationships that have not earned their trust?

Either way, the verdict will show us how the pie gets “carved up” and who gets smashed.